The total Unova system comprises 3 levels (blockchain/web3 level, smart contract level, distributed application level). To maintain the full decentralization of the system, each of these levels has their own pricing.

Crypto economic model

What is gas?

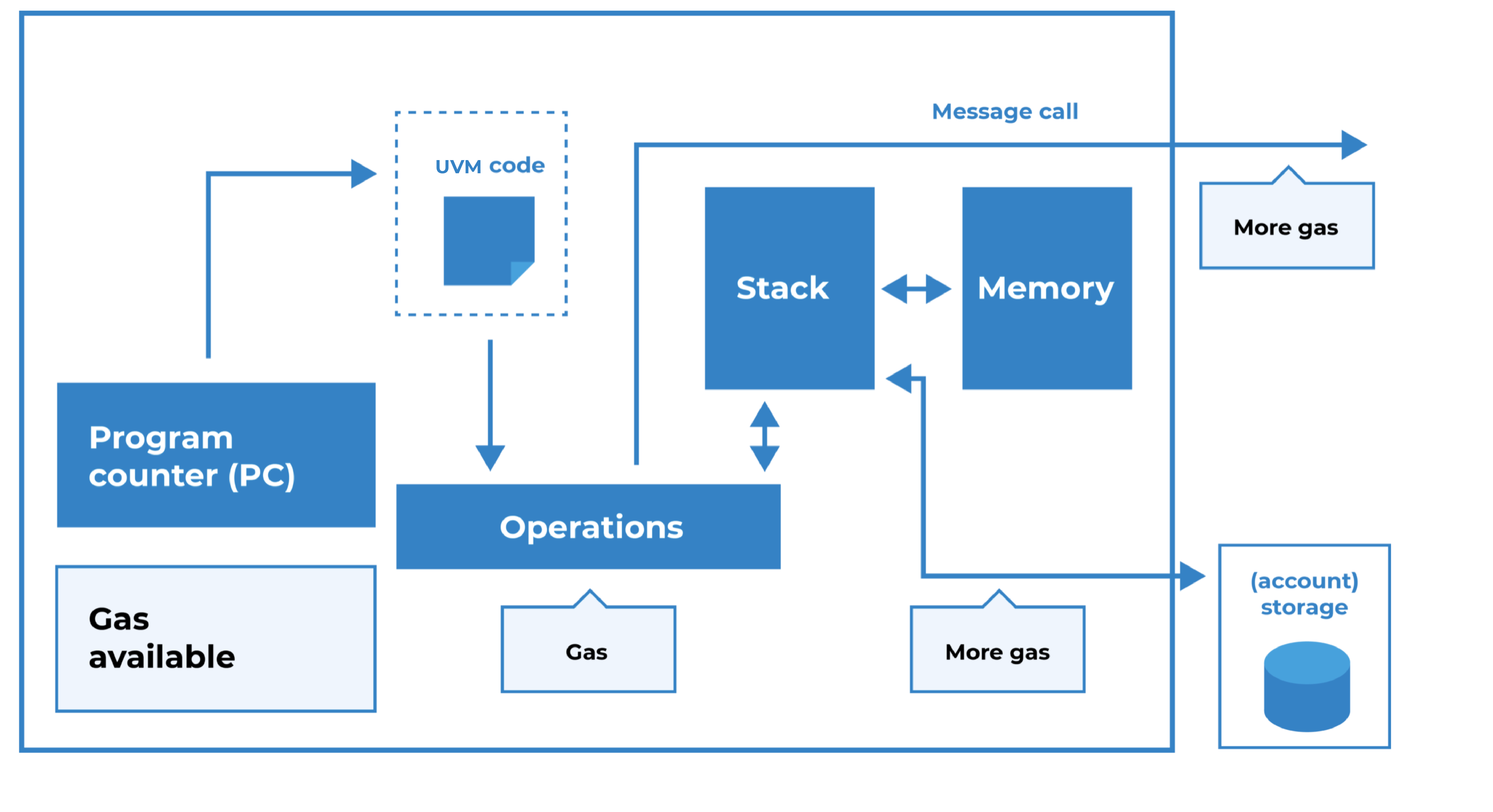

In a similar fashion to the Ethereum network, the Unova network uses the concept of gas.

Gas refers to the unit that measures the amount of computational effort required to execute specific operations on the network.

Since each Unova transaction requires computational resources to execute, each transaction requires a fee. Gas refers to the fee required to conduct a transaction on Unova successfully.

A standard transaction (financial transaction) requires 21 000 gas.

Transaction fees are paid in Unova’s native currency (UON). Gas prices are denoted in Gwei, which itself is a denomination of UON – each Gwei is equal to 0,000000001 UON. So, instead of saying each unit of gas costs 0,000000001 UON, you can say your gas costs 1 Gwei. This is a similar pricing model to Ethereum, with a few key differences.

Blockchain transactions:

Calculating the total transaction fee works as follows: Gas units (limit) * (Base fee + Tip)

Let’s say Bart must pay Yannick 1 UON. In the transaction, the gas limit is 21 000 units and the base fee is 50 Gwei. Bart includes a tip of 10 Gwei.

Using the formula above we can calculate this as 21 000 * (50 + 10) = 1 260 000 Gwei or 0,00126 UON.

The ‘(50+10)’ represents the gas price paid per unit of gas used.

When Bart sends the money, 1,00126 UON will be deducted from Bart’s account. Yannick will be credited 1 UON. Miner receives the tip of 0,00021 UON. Base fee of 0,00105 UON is burned.

Gas limit / Gas used

A standard transaction (financial transaction) requires a minimum of 21 000 gas. This represents the computational effort to execute the transaction. For executing smart contracts or any other type of transaction this will be more.

Gas limit is a value the user wishing to execute the transaction (or smart contract) can set. During the execution of the transaction, the network will determine what the actual ‘gas used’ is. As long as the gas limit is larger or equal to the gas used, the transaction will be executed successfully. If the gas limit set by the user exceeds the gas used, the remaining part will be paid back to the user. If the gas limit is set too low, the transaction will stop in the middle and the UON could be lost as the transaction fails. As long as the gas limit is set to 21 000 gas while executing a standard transaction, there is nothing to worry about.

The Metamask wallet will automatically make sure the right value is set.

Base fee

Each block has a base fee. This base fee is determined by the network and calculated based on the previous block. To execute a transaction the gas price must be at least equal to or larger than the base fee (this is set by choosing a max fee).

The base fee is calculated independently of the current block and is instead determined by the blocks before it – making transaction fees more predictable for users. When the block is mined this base fee will currently be credited to the Unova wallet removing it from current circulation. Later this will change, and the base fee will be “burned”, permanently removing it from from circulation. This allows Unova in the initial phase to use these base fees as a development budget.

The minimum base fee that the Unova network accepts is 50 Gwei. Taking this into account the cheapest standard transaction fee = 21 000 x (50 + 0) = 1 050 000 Gwei = 0,00105 UON.

The base fee is calculated by a formula that compares the size of the previous block (the amount of gas used for all the transactions) with the target size. The base fee will increase by a maximum of 12.5% per block if the target block size is exceeded. This exponential growth makes it economically non-viable for block size to remain high indefinitely.

The target block size is equal to 10 million gas and the block limit is 20 million gas in the Unova network.

|

Blocknumber |

Included Gas |

Fee Increase |

Current Base Fee |

|

1 |

10M |

0% |

50 Gwei |

|

2 |

20M |

0% |

50 Gwei |

|

3 |

20M |

12.5% |

56,25 Gwei |

|

4 |

20M |

12.5% |

63,28 Gwei |

|

5 |

20M |

12.5% |

71,19 Gwei |

|

6 |

20M |

12.5% |

80,09 Gwei |

|

7 |

20M |

12.5% |

90,10 Gwei |

|

8 |

20M |

12.5% |

101,36 Gwei |

Priority fee (tip)

A tip incentivizes the miners to include transactions in the block and avoids miners creating empty blocks. Even a small tip (0,000000001 UON) is sufficient. Tips also represent a priority fee, if transactions need to get preferentially executed ahead of other transactions in the same block a higher tip will be necessary to attempt to outbid competing transactions.

Max Fee

Since the user does not set the base fee but can set a priority fee, and the base fee is variable between blocks, the user can set a ‘max fee’ representing the maximum total gas price for their transaction.

Max fee = (base Fee + priority fee)

The max fee should be at least 50 Gwei, to cover the minimum base fee. The Metamask wallet will automatically make sure the right value is set, and suggest low, moderate, and aggressive estimates for max fees, depending on the market price.

Application Fee

Application fee is an additional amount, added to the transaction fee, which is a reward for developers within the Unova ecosystem.

Other Fees

Generally, there are additional development costs and in some cases SAAS fees for specific use cases.

Contact us about launching your own doing a pilot.

Supply chain focused pricing

Blockchain networks have a limit on the number of transactions that can be executed, which can lead to network congestion and high gas prices. The Proof-of-Authority consensus mechanism of Unova, and the fact that we have a supply chain focus, means that transactions do not need to compete (gas prices) with other transactions that may be executed on other networks. Therefore, the price can match the value of the supply chain smart contract executions and stay low and stable.

Simply put, the smart contracts created by Unova are executed by Type-2 (enterprise) nodes and mainly used for data distribution between supply chain stakeholders. Therefore, the values set to activate these smart contracts are fixed and stable.